Car Insurance

Insurance covers you against any sort of loss. While life insurance covers you against loss of life, car insurance insures you against any loss or damage that your four-wheeler may incur during its lifetime. The damages to the car come in the form of theft, natural disaster, third-party liabilities or accident. A car insurance protects you against that loss.

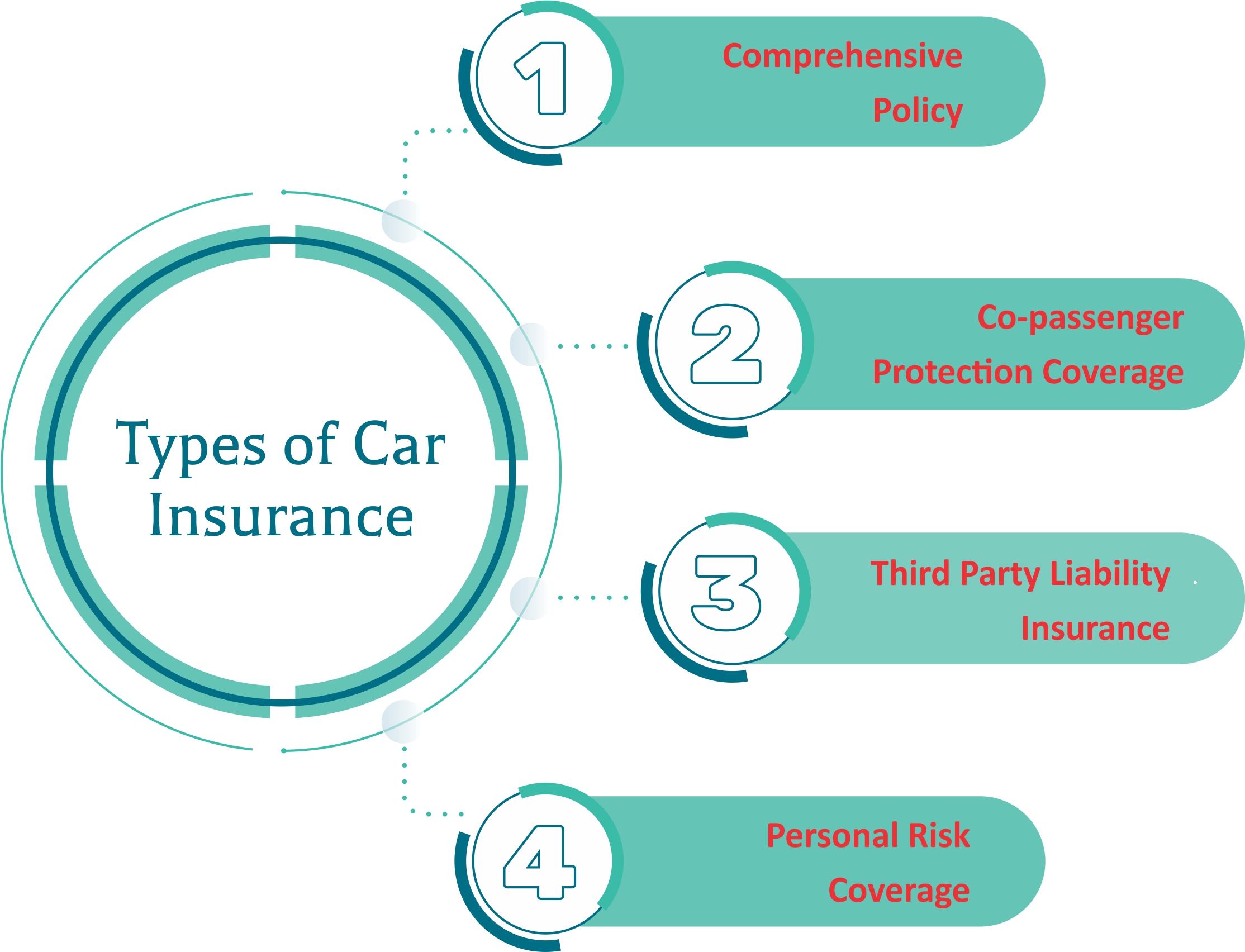

Comprehensive Policy:

This is the best form of car insurance policy that covers all kinds of damages. This is an end-to-end coverage. This means a comprehensive covers first party, third party, car and co-passenger. A comprehensive policy also insures against all kind of disasters, whether natural or man-made.

Co-passenger Protection Coverage:

As the name suggests this car insurance policy ensures 100% coverage in the case of co-passenger’s death or permanent disability. Some of the insurance providers provide this accidental coverage but charge an extra premium for it.

Third Party Liability Insurance:

As per the Indian law, it is mandatory to have a third party liability insurance along with a car insurance. If your car causes any harm to the third party or property, this insurance covers it.

Personal Risk Coverage:

This is the most basic form of coverage that only covers damage done to the car owner.

Step 1: Choose the cover you need for your car

Step 2: Insurance provider inspects the car

Step 3: Insurance Declared Value or IDV is calculated

Step 4: You intimate the insurance provider in the event of damage

Step 5: You need to submit the documents

Step 6: In case of Cashless Claim Mode the Insurance Provider analyses the garage estimate and pays after repair

Step 7: In the case of Reimbursement Claim Mode the Insurance Provider reimburses the repair amount

A car insurance covers the following:

Step 1: Inform the insurance provider

Step 2: Apply for the claim with relevant documents

Step 3: Get the claim

Before you delve into it, understand that these covers differ from insurance provider to insurance provider. Following are some of the most common add-on covers that you can get.

We know what damages are covered while you take a car insurance. Following are the things that are not covered.

If your Insurance Provider gives that option, you can renew your car insurance online. Here’s how you can do it.

Asset Investment

Cards

Stock Market

Contact Us

Mutual Funds

Disclaimer

Privacy Policy

FAQs

CIN No.

U66000MH2018PTC305850

CIN No.

U66000MH2018PTC305850

Register Office : Unit No. 1617, 16th floor,

Rupa Solitaire,

Koparkhairne, Navi Mumbai - 400710.

Mobile No. : +91 7992 472 994

Email : care@uponly.in

Be updated with the latest development in the industry and our steps towards bettering it. Follow our social media handles now.

Copyright © 2020 Uponly.in(CCIPL) All Rights Reserved