What is a loan against property?

Also known as the mortgage loan, loan against property is a secured loan that is offered by banks and other lenders against any commercial or residential property that is owned by the lender. The property is kept as collateral till the loan is repaid. Usually, the amount offered is 70% off the value of the property and when sanctioned, can be used for any purpose.

What are the features of loan against property?

What are the documents required for a loan against property?

The documents required for this type of loan usually depends on the type of applicant; salaried or self-employed.

If you are salaried, you need to submit the following documents:

If you are a self-employed person, you need to submit the following documents:

The chosen lender can ask for more documents.

What are the benefits of prepaying loan against property?

For any other type of loan that you apply for, there are foreclosure charges or prepayment penalties. However, in the case of loan against property, prepayment is rewarded. Here are some of the benefits to take note of:

Quick questions:

Are you a salaried adult with a minimum wage of INR 15,000 and within the age of 21 to 60 years? Then yes, you are eligible.

Similarly, are you a self-employed adult with a minimum gross income of 5 lakh and within the age group of 21 to 68 years? Then yes again, you are eligible for a personal loan.

Please note that these criteria are not exhaustive and can be changed depending upon company policy or government regulations, with due intimation.

No collateral or security required

No collateral or security required

![]() Can be used for any purpose

Can be used for any purpose

Comes with a flexible tenure

Comes with a flexible tenure

Minimal to no documentation

Minimal to no documentation

Quick and easy disbursal of funds

Quick and easy disbursal of funds

Personal loan interest rates vary as per the bank. Not only this, there are certain factors on the basis of the application filed, that also impact the rates. Here are a few:

Here are some handy tips to tackle your personal loan interest rate:

Personal loan interest can be calculated either on the basis of a flat interest rate method or the reducing balance method. While the former requires the EMI to be calculated only on the original principal amount, in the case of the latter the EMI is calculated on the principal amount that is outstanding after each payment. The calculation method depends on the bank.

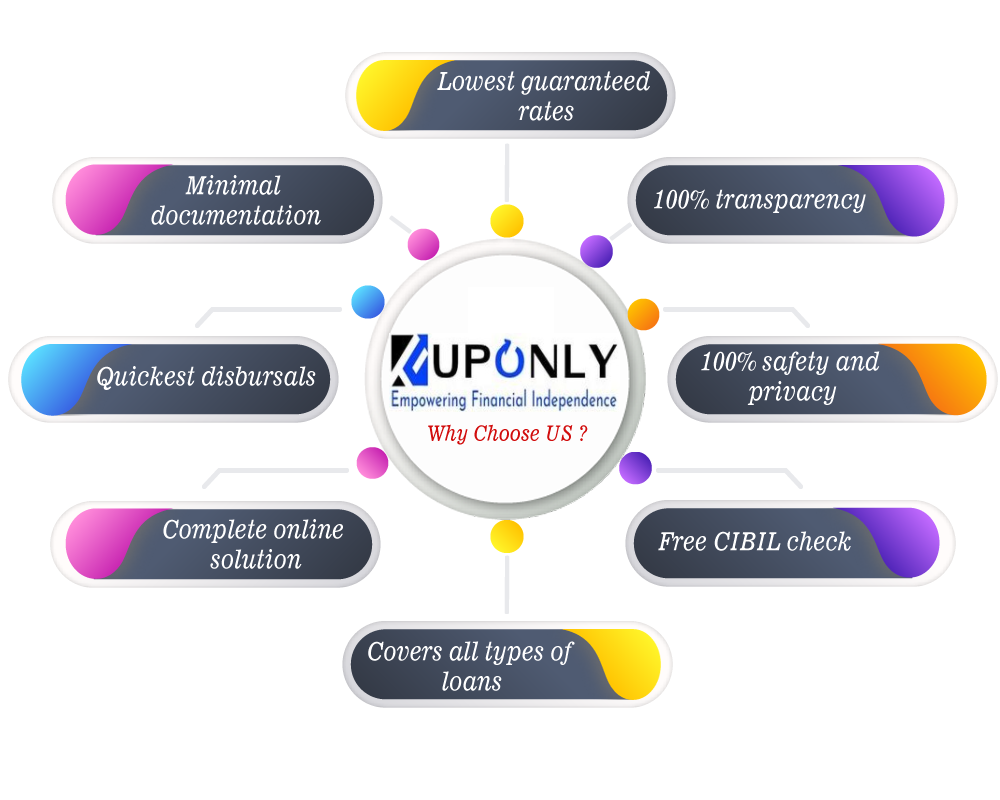

Want to apply for a personal loan? You can do so by approaching either a bank or an NBFC, and let us at Uponly.in guide what’s best for you. However, one thing that is common across all the personal loan lenders, is the documentation required. There are certain basic ones that need to be submitted. Following is a basic checklist to be followed for personal loan documents:

Please note that the list is by no means exhaustive or definitive and may vary depending upon the lender’s policies.

Quick answer? By using our personal loan EMI calculator. While our experts are present to guide you and answer all your personal loan queries, it is better to be vigilant. Just enter the personal loan amount you require, the loan tenure, and the interest rate, and you will get your EMI amount.

Step 1: Enter your personal details

Step 2: Enter your workplace details and work experience

Step 3: Enter existing loan details, if any

Step 4: Choose from the list of banks curated as per your needs and provide extra information

Step 5: Get instant approval from the lender

Step 6: Get further guidance from our team and have the money transferred to your account

Easy and effective, that’s how we at Uponly.in work.

This is an important piece of information regarding your personal loan. Loan verification is crucial. Here are the key steps to it.

Step 1: Submit an application via Uponly.in, which the chosen lender would receive.

Step 2: The lender’s representative would call to verify the details and pick up the relevant documents.

And you are done! Post this two-step verification your documents are further checked and your personal loan application is approved on the basis of the same. A loan agreement is prepared which requires the applicant’s signature, post which the amount is disbursed.

There are two modes of personal loan disbursal, depending upon the lender and your preferred choice:

Option 1: Direct transfer to the savings or current account of the applicant

Option 2: Cheque or draft sent to the mailing address

While most of the applicants are eligible for a personal loan, there are certain factors that affect the eligibility and further the loan amount. Here are a few:

You can pay your personal loan in a few simple easy ways. Take your pick and get going:

Uponly.in believes that you should have complete information about the loans you process. This includes personal loan too. Here are the fee and charges involved:

Sign up for your dreams with Uponly.in hassle-free personal loan process.

Asset Investment

Cards

Stock Market

Contact Us

Mutual Funds

Disclaimer

Privacy Policy

FAQs

CIN No.

U66000MH2018PTC305850

CIN No.

U66000MH2018PTC305850

Register Office : Unit No. 1617, 16th floor,

Rupa Solitaire,

Koparkhairne, Navi Mumbai - 400710.

Mobile No. : +91 7992 472 994

Email : care@uponly.in

Be updated with the latest development in the industry and our steps towards bettering it. Follow our social media handles now.

Copyright © 2020 Uponly.in(CCIPL) All Rights Reserved