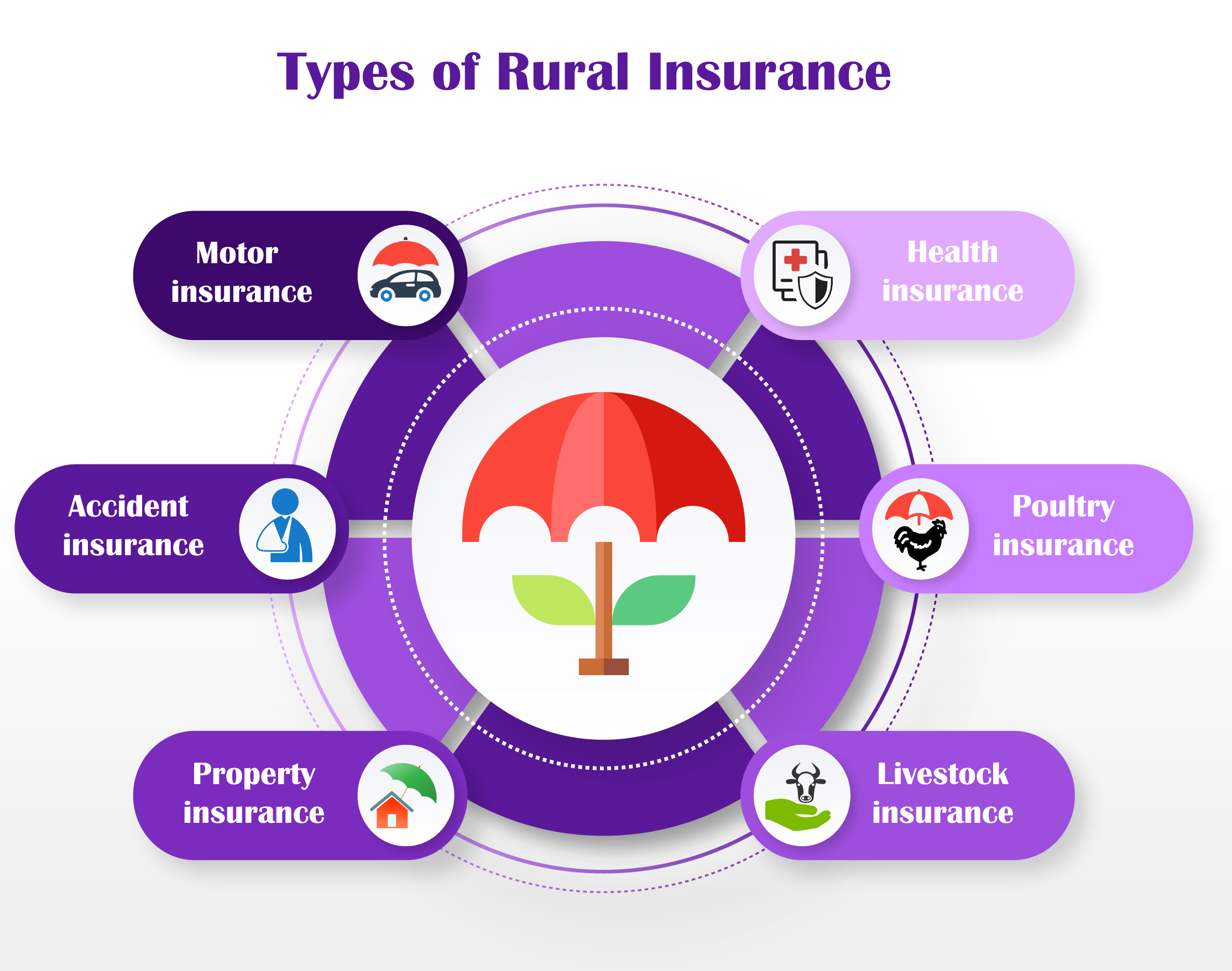

Nearly 70% of the Indian population is engaged in agriculture and resides in the rural parts. Due to a lack of facilities that urban India enjoys, rural India’s people need insurance more than ever before. That’s why rural insurance came into play.

What is rural insurance?

Rural insurance is a form of cover that is there to protect the rural policyholder against any damage or loss that they may incur during their day-to-day life.

| INCLUSIONS | EXCLUSIONS |

|---|---|

| Poultry insurance | Death or disability of the cattle due to neglect or overwork |

| Hut insurance | Illegal slaughter of the cattle |

| Honey bee insurance | Death by overcrowding |

| Failed-well insurance | Loss of vehicle due to confiscation by the government |

| Sericulture insurance | Pre-existing faults and damages to the property |

| Lift irrigation insurance | Cost of dismantling the product while moving it to and from the workshop |

| Sheep goat insurance | Loss and damage from theft |

| Animal driven cart insurance | Clandestine sale |

| Agricultural pump set policy | |

| Gramin personal accident insurance | |

| Farmers’ package insurance | |

| Horticulture’s insurance scheme | |

| Cycle rickshaw policy |

Asset Investment

Cards

Stock Market

Contact Us

Mutual Funds

Disclaimer

Privacy Policy

FAQs

CIN No.

U66000MH2018PTC305850

CIN No.

U66000MH2018PTC305850

Register Office : Unit No. 1617, 16th floor,

Rupa Solitaire,

Koparkhairne, Navi Mumbai - 400710.

Mobile No. : +91 7992 472 994

Email : care@uponly.in

Be updated with the latest development in the industry and our steps towards bettering it. Follow our social media handles now.

Copyright © 2020 Uponly.in(CCIPL) All Rights Reserved