What is life insurance?

Life insurance is a protective cover offered to the family, in the event of the sudden death or permanent disability of the sole breadwinner. Unlike health insurance where the holder gets the claim, here, the amount is received by the beneficiary of the holder.

One never knows what curveball life may throw their way. A random misstep, one accident, a pandemic, anything can arise any moment, but we need to be prepared. And that’s why, it is important to have a life insurance policy that can take care of your loved ones even when you are not around.

There are three goals of a life insurance policy

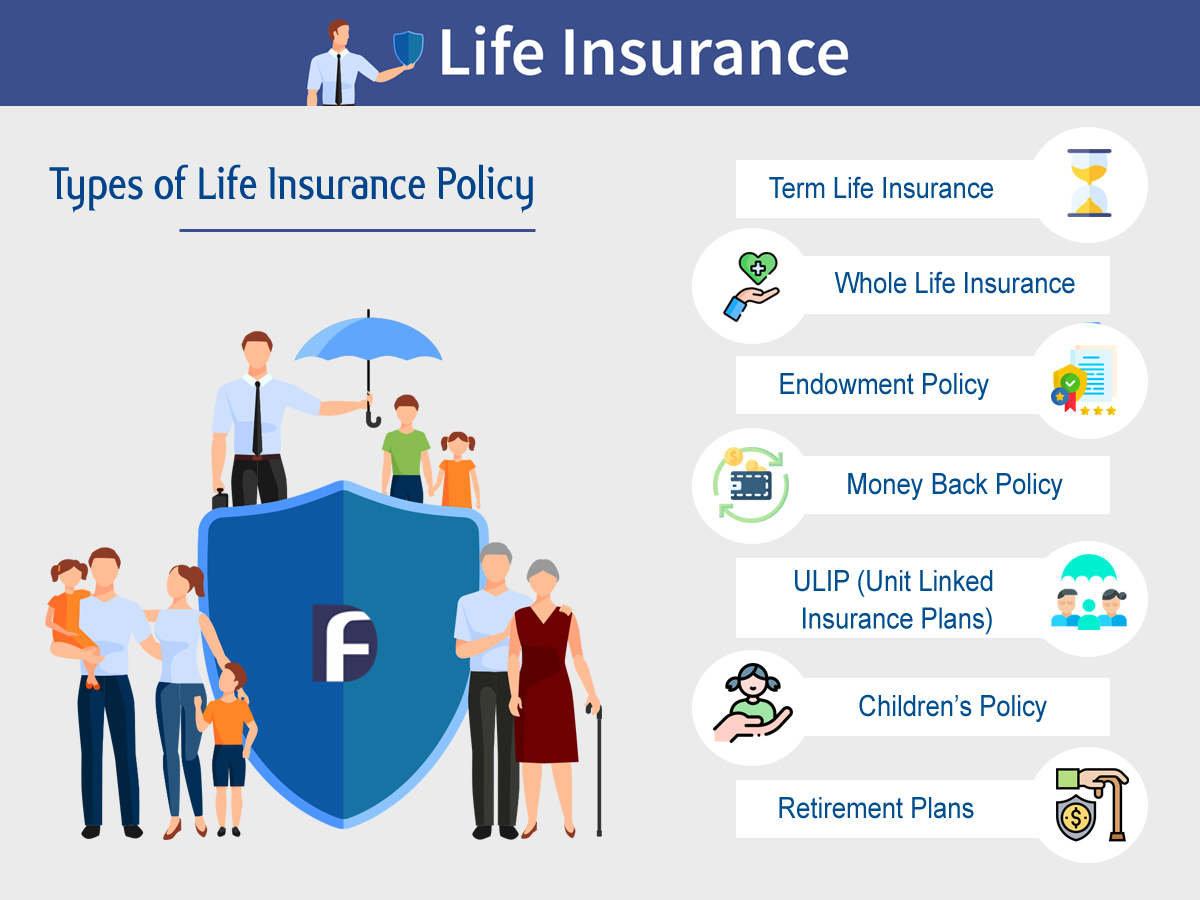

What are the various types of life insurance policy?

Types of life insurance policy

What are life insurance covers?

Do you know you can enhance the protection of your life insurance by adding a cover to it. Following are some of the ways in which you can do that.

Ask your life insurance agent, after you have reached them via uponly.in as to what more covers can they provide along with the life insurance. The more, the better protected you and your family are.

Are there any exclusions with respect to life insurance?

Just like health insurance, life insurance too has certain exclusions. Let us list down a few for you. Of course, the list is not exhaustive. It varies from one insurance company to another.

Are there any tax benefits with life insurance?

You can enjoy benefits for up to 150000 under section 80C of Income Tax Act, 1961 when it comes to the insurance premium that you are paying. You can also claim deductions on the additional rider cover.

Asset Investment

Cards

Stock Market

Contact Us

Mutual Funds

Disclaimer

Privacy Policy

FAQs

CIN No.

U66000MH2018PTC305850

CIN No.

U66000MH2018PTC305850

Register Office : Unit No. 1617, 16th floor,

Rupa Solitaire,

Koparkhairne, Navi Mumbai - 400710.

Mobile No. : +91 7992 472 994

Email : care@uponly.in

Be updated with the latest development in the industry and our steps towards bettering it. Follow our social media handles now.

Copyright © 2020 Uponly.in(CCIPL) All Rights Reserved